Best Low Interest Credit Cards

Save money with the top low interest credit cards: Updated January 2024

2 Cards in Total

The difference in just a few percentage points can make a significant difference if you are carrying a balance from month to month consistently, or if you just make a large purchase on a credit card. If you know you may be carrying a balance at times month over month, to mitigate the interest charged on your credit card, it's smart to search for a low-interest rate credit card offer. Credit cards with the lowest interest rates, or rates below the national average, usually have stricter requirements when it comes to qualifying for the card so it's wise to search for these types of offers only if you're credit standing will be viewed as good-excellent by an issuer.

Advertiser Disclosure

CreditCardReviews.com is an independent, advertising-supported comparison service. Many of the offers that appear on this site are from companies from which CreditCardReviews.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCardReviews.com does not include the entire ecosystem of credit offers available to the US market. CreditCardReviews.com has partnerships with issuers and referral platforms including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, Well Fargo, and Cardratings.

Rewards Cards

Card Types

Issuers

0 Ratings & Reviews

Intro Purchase APR

N/A

Intro Transfer APR

N/A

Regular APR

19.24% - 28.24%

Annual Fee

$0

Why We Like This Card

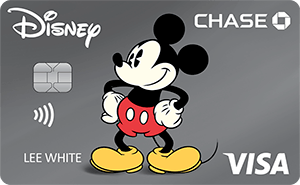

The perfect card for Disney fans, and a great way to save on Disney vacations and merch, with 0% promo APR on select Disney vacation packages for 6 months from the date of purchase, 10% off select merchandise purchases at select locations, 10% off select dining locations at the Disneyland® and Walt Disney World® Resorts (depending on the day!), and 10% discounts on select purchases at shopDisney.com. You will also earn $250 Disney Dollars after spending $500 in the first 3 months.

0 Ratings & Reviews

Intro Purchase APR

N/A

Intro Transfer APR

N/A

Regular APR

19.49% - 27.49% (variable)

Annual Fee

$0

Why We Like This Card

The perfect card for Amazon Prime users. You will be charged $0 in credit card fees, and will be able to redeem daily rewards at Amazon.com without waiting - as early as the very next day. Receive a $100 Amazon Gift Card instantly upon approval, and earn 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and with Chase Travel purchases, if you also have an eligible Prime membership.